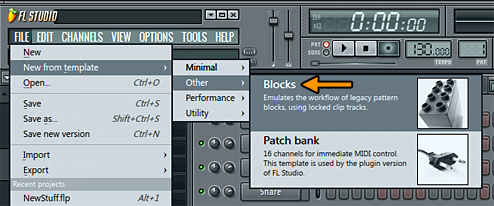

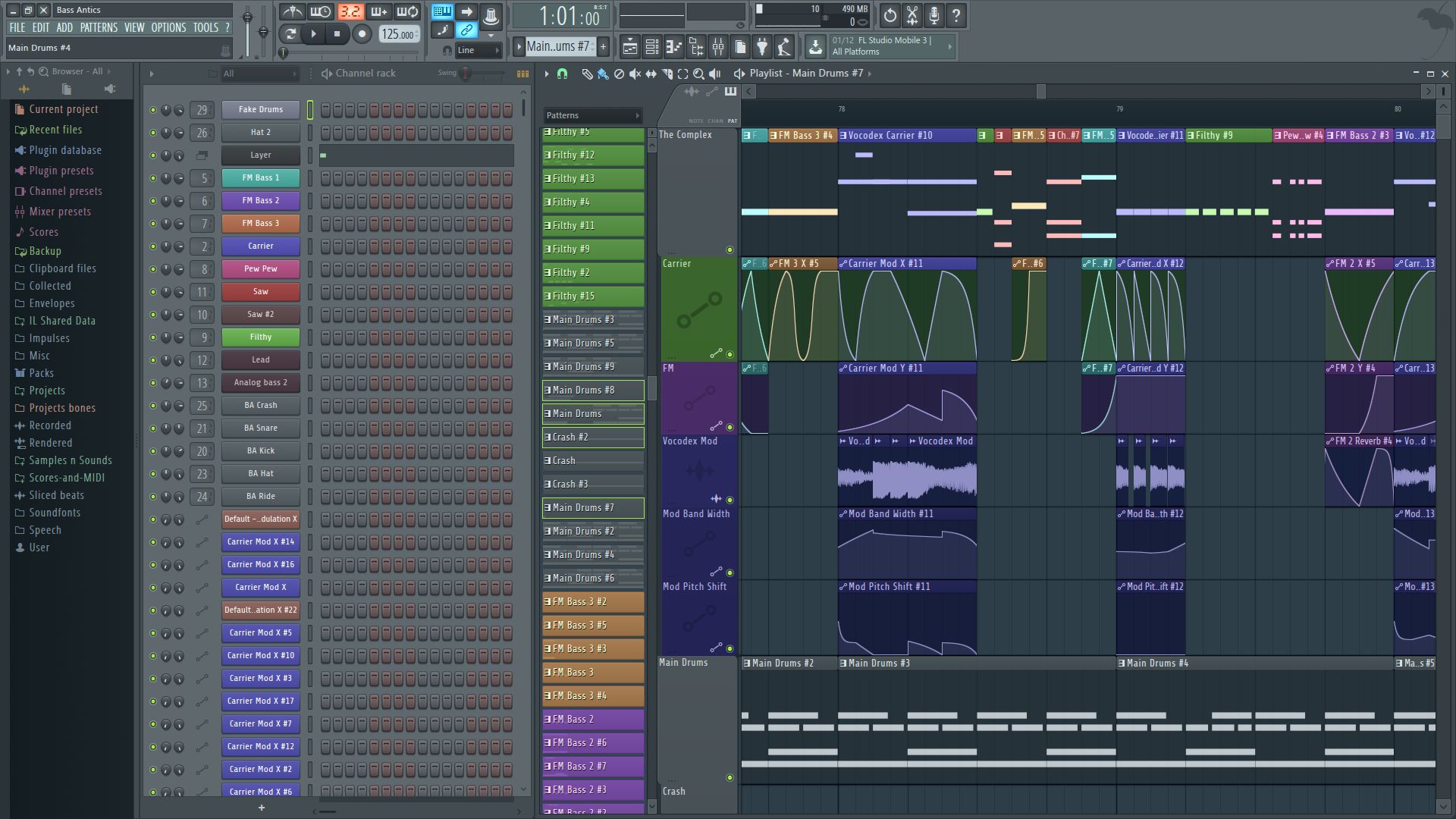

That said, 9.6 does provide the option to revert back to pattern blocks by activating the ‘enable legacy pattern blocks' found under the ‘General Settings' tab. However, by the time FL Studio hits version 10, pattern blocks will be obsolete and the option to revert to legacy patterns will also be removed. 🔥 Best Free Sample Loop Kit Packs 2020 - Works with FL Studio, Logic Pro X, Ableton and any other DAW This heavyweight line up of free sample loops packs is a must-have for any producer wanting to get some quick inspiration in 2020. I updated to Fl studio 12 but I cannot for the life of me figure out how to get legacy blocks. I have tried going to general settings but there is no o. Pattern blocks are no longer available in FL Studio 12, and there are no workarounds to activate them. The best solution would be to use the Blocks template for your projects. To do so you can go 'File New from template Other Blocks'. Right-Click tab - Show Pattern Clip menu.; Note - Uses the color settings of the parent pattern (notes & event). Note color is set from within the Piano roll.Event data always displays in pink, so anyone uncomfortable about being seen using pink in the Playlist needs to 'suck it in' and stop being a 'big cry baby' about it.

In trading, everyone always wants to complicate everything – why? Simply because having 8 screens with a lot of blinking lights is what we see on TV whenever we hear the word trader. Now while some of the infos these people in the pit, or wherever, have on their screens are certainly beneficial, I promise you, you can trade just as profitably with one screen alone and only 1 to 3 indicators, or even no indicators. You don't even have to read the tape, the DOM, the ladder, the matrix, whatever. You simply have to observe, mainly: lows and highs, and where they occur in relation to the last lows and highs. Sounds familiar? Enter the 1-2-3 pattern. Or, A-B-C pattern, to your liking.

This pattern is comprised of a low, a higher high, a higher low, and a break of the higher high (in case we are going long). In the picture above, at the break of point B we are going long, stops go below point C. Some people set a pending order at B, some people wait for a confirmed break. The 1-2-3 pattern works best when going with the trend but can also be used as a reversal pattern when bouncing from S/R and after we have topping structures in place like H&S, double/triple tops and bottoms, etc. The 1-2-3 brings enough momentum with it that we almost always can go to breakeven before price reverses on us, and if it doesn't, we can get great runs out of this momentum pattern.

Targets are usually Fibonacci extensions and/or the next S/R level, or when we see signs of price exhaustion like divergence on one of our indicators. Here is an example where when the 127.2 extension reached, I usually target the 161.8 – however in this case it was not reached.

Now there is something called the trader's trick entry, coined by Joe Ross (who also coined the Ross Hook, will get there in a minute). This entry method suggests actually entering between point C and B, before point B is reached – and actually going to breakeven when point B is reached. That way we can make sure we are not going long at a market top. This can be achieved by using Fibonacci retracements, S/R retests, and by other means – what I usually do, however, is to simply look for another 1-2-3 between point B and C, in order to get in (or other patterns, but this is material for another article). Here is an example:

As you can see in the picture above on the right side, between point B and C of the original pattern, we got another 1-2-3 which we could use to get in before we actually reached point B, which in this case saved us from a stressful trade – it would not have been a loss as our SL always goes below point C, but it would have been stressful to say the least.

Now, after point B broke, we have two additional means of stacking our position. One is the retrace to point B, as in this example:

The Ross Hook

And finally, the so-called Ross Hook (basically another 1-2-3), which is the first retrace after a successful 1-2-3 formation. In the example above, we would enter as follows.

So, there you have it, a potential 3 entries on one formation. Important is that you know where the overall trend is going, and that you don't trade every tiny retrace. This is where my indicators come into play: I use the MACD on the longer timeframe window to confirm momentum, and the CCI on the trading timeframe window to confirm that a pullback has indeed been deep enough to build up enough momentum to the other side (swingin', swingin').

Fl Studio Pattern Blocks For Sale

If you spot patterns like Head and Shoulders, double tops/bottoms, and other popular topping structures, on the higher timeframe, and a 1-2-3 on the lower timeframe, you got yourself a great trade. Or, you wait until a high or low gets broken on the higher timeframe, and then wait for a 1-2-3 on the lower timeframe to get in. All viable options to enter with the trend, with the momentum, and with structure in your back to protect your stoploss.

Fl Studio Pattern Blocks

Overall, the 1-2-3 is an incredibly awesome pattern that follows the simplest market analysis there is: where are our highs, and where are our lows, and in which relation to each other did they appear on our charts?

That said, 9.6 does provide the option to revert back to pattern blocks by activating the ‘enable legacy pattern blocks' found under the ‘General Settings' tab. However, by the time FL Studio hits version 10, pattern blocks will be obsolete and the option to revert to legacy patterns will also be removed. 🔥 Best Free Sample Loop Kit Packs 2020 - Works with FL Studio, Logic Pro X, Ableton and any other DAW This heavyweight line up of free sample loops packs is a must-have for any producer wanting to get some quick inspiration in 2020. I updated to Fl studio 12 but I cannot for the life of me figure out how to get legacy blocks. I have tried going to general settings but there is no o. Pattern blocks are no longer available in FL Studio 12, and there are no workarounds to activate them. The best solution would be to use the Blocks template for your projects. To do so you can go 'File New from template Other Blocks'. Right-Click tab - Show Pattern Clip menu.; Note - Uses the color settings of the parent pattern (notes & event). Note color is set from within the Piano roll.Event data always displays in pink, so anyone uncomfortable about being seen using pink in the Playlist needs to 'suck it in' and stop being a 'big cry baby' about it.

In trading, everyone always wants to complicate everything – why? Simply because having 8 screens with a lot of blinking lights is what we see on TV whenever we hear the word trader. Now while some of the infos these people in the pit, or wherever, have on their screens are certainly beneficial, I promise you, you can trade just as profitably with one screen alone and only 1 to 3 indicators, or even no indicators. You don't even have to read the tape, the DOM, the ladder, the matrix, whatever. You simply have to observe, mainly: lows and highs, and where they occur in relation to the last lows and highs. Sounds familiar? Enter the 1-2-3 pattern. Or, A-B-C pattern, to your liking.

This pattern is comprised of a low, a higher high, a higher low, and a break of the higher high (in case we are going long). In the picture above, at the break of point B we are going long, stops go below point C. Some people set a pending order at B, some people wait for a confirmed break. The 1-2-3 pattern works best when going with the trend but can also be used as a reversal pattern when bouncing from S/R and after we have topping structures in place like H&S, double/triple tops and bottoms, etc. The 1-2-3 brings enough momentum with it that we almost always can go to breakeven before price reverses on us, and if it doesn't, we can get great runs out of this momentum pattern.

Targets are usually Fibonacci extensions and/or the next S/R level, or when we see signs of price exhaustion like divergence on one of our indicators. Here is an example where when the 127.2 extension reached, I usually target the 161.8 – however in this case it was not reached.

Now there is something called the trader's trick entry, coined by Joe Ross (who also coined the Ross Hook, will get there in a minute). This entry method suggests actually entering between point C and B, before point B is reached – and actually going to breakeven when point B is reached. That way we can make sure we are not going long at a market top. This can be achieved by using Fibonacci retracements, S/R retests, and by other means – what I usually do, however, is to simply look for another 1-2-3 between point B and C, in order to get in (or other patterns, but this is material for another article). Here is an example:

As you can see in the picture above on the right side, between point B and C of the original pattern, we got another 1-2-3 which we could use to get in before we actually reached point B, which in this case saved us from a stressful trade – it would not have been a loss as our SL always goes below point C, but it would have been stressful to say the least.

Now, after point B broke, we have two additional means of stacking our position. One is the retrace to point B, as in this example:

The Ross Hook

And finally, the so-called Ross Hook (basically another 1-2-3), which is the first retrace after a successful 1-2-3 formation. In the example above, we would enter as follows.

So, there you have it, a potential 3 entries on one formation. Important is that you know where the overall trend is going, and that you don't trade every tiny retrace. This is where my indicators come into play: I use the MACD on the longer timeframe window to confirm momentum, and the CCI on the trading timeframe window to confirm that a pullback has indeed been deep enough to build up enough momentum to the other side (swingin', swingin').

Fl Studio Pattern Blocks For Sale

If you spot patterns like Head and Shoulders, double tops/bottoms, and other popular topping structures, on the higher timeframe, and a 1-2-3 on the lower timeframe, you got yourself a great trade. Or, you wait until a high or low gets broken on the higher timeframe, and then wait for a 1-2-3 on the lower timeframe to get in. All viable options to enter with the trend, with the momentum, and with structure in your back to protect your stoploss.

Fl Studio Pattern Blocks

Overall, the 1-2-3 is an incredibly awesome pattern that follows the simplest market analysis there is: where are our highs, and where are our lows, and in which relation to each other did they appear on our charts?

Fl Studio 10 Pattern Blocks

The 1-2-3 provides us with clear entries, clear stoplosses and clear targets through extensions. What more could we ask for? Let me know in the comments below what you think!